Table of Contents

Buy USDT, USDC DAI: 5 Easy Methods

This guide explains how to buy USDT, USDC, and DAI using the five most popular methods, including exchanges, bank transfers, cards, P2P platforms, crypto ATMs, and mobile apps. It breaks down the benefits of each option, helping readers choose the fastest and most cost-effective way to purchase stablecoins. The article also highlights key fees to consider and common mistakes to avoid. Strong emphasis is placed on security best practices to protect funds and personal data. By the end, readers know exactly how to buy stablecoins safely and confidently in 2026.

.avif)

Introduction to Stablecoins

Stablecoins are a type of digital currency designed to keep their value stable. Unlike other cryptocurrencies, which can fluctuate wildly, stablecoins aim to maintain a fixed value. This stability makes them a popular choice for people who want to use digital money without worrying about price changes.

Many stablecoins are linked to traditional money like the US dollar. This link, often called pegging, helps keep their price steady. For example, if you buy one USDT, USDC, or DAI, it is usually worth about one US dollar. This makes it easy for people to understand and trust their value.

Stablecoins are used for various purposes. People can use them to send money across borders quickly and cheaply. They are also popular in trading, allowing users to move money between different cryptocurrencies without converting it back to traditional money. This flexibility makes stablecoins a key part of the digital currency world.

Why Buy USDT, USDC & DAI?

People often ask why they should invest in stablecoins like USDT, USDC, and DAI. These digital coins are tied to real-world currencies, like the US dollar. This makes them less risky than other cryptocurrencies that can jump up and down in value. Let's say you want to save money for a big purchase next year. Storing your money in stablecoins could help keep it safe from market swings.

Using stablecoins can also make transactions faster and cheaper. Imagine sending money to a friend in another country. Traditional banks can take days and charge high fees. But with USDT or USDC, the transfer is usually done in minutes, with lower costs. This speed can be a game-changer for both personal and business transactions.

DAI offers an interesting twist. It's a stablecoin managed by smart contracts on the blockchain, not by a central bank. This decentralization offers more control and transparency. If you value privacy and autonomy, DAI could be your go-to choice.

Choosing the Right Exchange

Picking the right exchange to buy USDT, USDC, and DAI can feel a bit like choosing a new car. You want reliability, trustworthiness, and something that fits your needs. Start by looking at the reputation of the exchange. Is it well-known and respected in the crypto community? Check user reviews and any news about security breaches.

Fees are another important factor. Some exchanges charge a percentage of your transaction, while others have flat fees. You want to find a balance between cost and convenience. Ease of use matters too. If the platform is too complex, it could lead to mistakes. Look for a user-friendly interface.

Consider the payment methods available. Can you use your credit card, bank transfer, or PayPal? More options mean more flexibility. Lastly, check if the exchange supports the stablecoins you want to buy. Not all exchanges offer USDT, USDC, and DAI. By taking these steps, you can choose an exchange that works best for you.

Using a Bank Transfer

Buying stablecoins like USDT, USDC, or DAI through a bank transfer can be a straightforward method. First, select a cryptocurrency exchange that allows bank transfers. Popular exchanges often have this option. Start by linking your bank account to the exchange. You might need to verify your identity, so have your ID ready. Once your account is linked, you'll transfer funds from your bank to the exchange. It may take a few days for the transfer to complete, depending on your bank's processing speed.

When your funds arrive in the exchange account, choose the stablecoin you want to buy. Then, enter the amount you wish to purchase and confirm the transaction. Bank transfers usually have lower fees compared to credit cards. This makes them a cost-effective choice. However, if you're in a rush, the slower processing time might not be ideal. Always check if there are any fees involved with your bank. Each bank's policies can vary, and it's good to know what to expect.

Credit and Debit Card Purchases

Buying stablecoins like USDT, USDC, and DAI with credit or debit cards is a popular choice. Why? It's quick and straightforward, just like buying your favorite online products. Many crypto exchanges allow you to link your card directly to their platform. Once linked, you can purchase stablecoins in just a few clicks.

It's important to know that some exchanges may charge a fee for card transactions. Fees can vary, so it's smart to compare before making a purchase. Also, keep an eye on your bank's foreign transaction fees, as these can add to your costs.

When using this method, security is key. Ensure your chosen exchange uses strong security measures. This helps protect your card and personal information. Always use trusted and verified platforms to avoid scams. Buying stablecoins with a card is easy, but it's wise to stay informed about costs and safety.

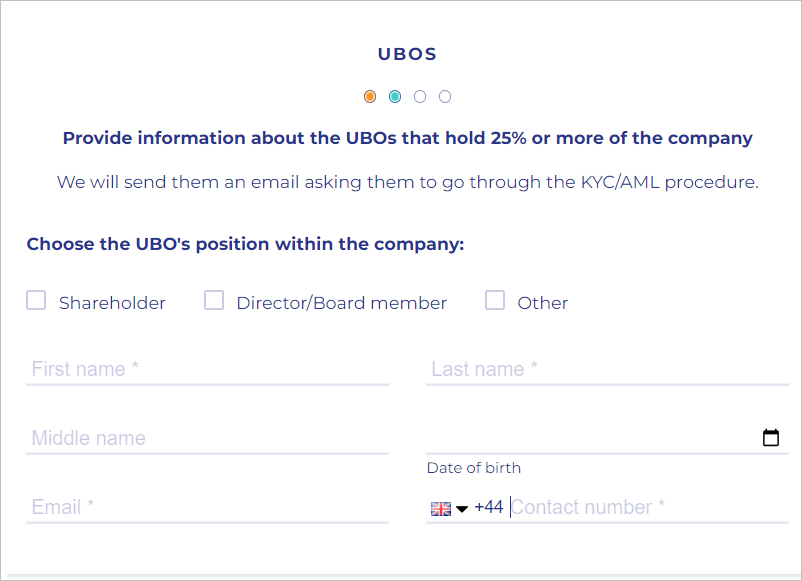

Peer-to-Peer (P2P) Platforms

Buying stablecoins like USDT, USDC, and DAI through P2P platforms can be a straightforward process. These platforms let you trade directly with another person, bypassing any middlemen. You can often find better deals because you're negotiating directly with sellers.

To get started, you'll need to register on a P2P platform. Most platforms require identity verification, but this is usually quick. Once registered, browse through the listings to find someone selling the stablecoin you want. Check their reputation score to ensure they're trustworthy.

After choosing a seller, you can initiate a trade. The platform will hold the stablecoin in escrow until the payment is complete. Payment methods vary, including bank transfers and digital wallets. Once the seller confirms the receipt of payment, the platform releases the stablecoin to you. This process makes P2P platforms a flexible option for buying stablecoins.

Using Crypto ATMs

Crypto ATMs have become a popular choice for people looking to buy stablecoins like USDT, USDC, and DAI. These machines offer a straightforward way to purchase digital currencies using cash or a credit card. You can find them in various locations, such as malls, convenience stores, and even airports.

To use a crypto ATM, you first need to find one near you. Websites and apps can help locate these machines. Once you reach the ATM, you choose the type of stablecoin you want to buy. The screen will guide you through the process, ensuring it's easy to follow.

Most crypto ATMs require you to scan a QR code from your digital wallet. This step links the purchased stablecoins directly to your wallet. If you don't have a digital wallet, some ATMs offer to create one for you on the spot. This feature is handy for beginners who might not have set up a wallet yet.

After choosing the stablecoin and scanning your wallet's QR code, you insert cash or use your credit card to make the purchase. The machine will show you the current rate and any fees involved. It's vital to check these rates and fees to ensure you're getting a good deal.

Crypto ATMs typically charge higher fees compared to online exchanges. This is due to the convenience they offer. But for those who prefer a quick, in-person transaction, the extra cost might be worth it. Plus, the process is often faster than waiting for bank transfers when buying online.

Overall, crypto ATMs provide a user-friendly option for buying stablecoins. With clear instructions and immediate transactions, they cater to both beginners and experienced users. As more ATMs pop up globally, they continue to make crypto transactions accessible to everyone.

Mobile Apps for Quick Purchases

Buying stablecoins like USDT, USDC, and DAI using mobile apps is a breeze in 2026. With just a tap, you can access digital currencies right from your smartphone. Let's explore how mobile apps have revolutionized the way we purchase stablecoins.

First off, mobile apps offer convenience. You can buy stablecoins anytime, anywhere. Whether you're at home, on the go, or even on vacation, your smartphone becomes a powerful tool for managing your digital assets. This flexibility is a game-changer for many people.

Now, let's talk about security. Mobile apps have stepped up their game with robust security features. Many apps use two-factor authentication, biometric logins, and encryption to protect your transactions. This ensures that your data and funds are safe from unauthorized access.

When it comes to speed, mobile apps are hard to beat. Transactions are often completed in seconds. This is especially useful when you need to buy stablecoins quickly due to market changes. No more waiting around for lengthy confirmations.

Mobile apps also offer user-friendly interfaces. They are designed to be intuitive, so even beginners can navigate through the app without hassle. Most apps provide step-by-step guides or tutorials to help you through the buying process.

Payment options are another highlight. Mobile apps typically support various payment methods like credit cards, bank transfers, and sometimes even PayPal. This variety makes it easier to choose a method that suits you best.

Customer support is also at your fingertips. Many mobile apps provide in-app chat support or detailed FAQs to assist users. If you face any issues, help is just a click away.

Let's not forget about notifications. Mobile apps can send you instant alerts about price changes or transaction statuses. This keeps you updated on your investments and helps you make timely decisions.

In 2026, buying stablecoins like USDT, USDC, and DAI through mobile apps is not just a trend, it's a preferred choice for many. The convenience, security, and speed make it a favored method for both new and seasoned users. So, if you haven't tried it yet, exploring mobile apps for stablecoin purchases might be a smart move.

Fees to Consider

When buying stablecoins like USDT, USDC, and DAI, fees can significantly impact your purchasing decision. Understanding these fees can help you find the best deals and avoid unnecessary costs. Let's break down the most common fees you may encounter.

Firstly, there's the transaction fee. This fee is charged by the platform where you buy your stablecoins. It can be a flat fee or a percentage of your purchase amount. For example, if a platform charges a 1% transaction fee and you're buying $100 worth of USDT, you'll pay an additional $1.

Another type of fee is the withdrawal fee. Once you've bought stablecoins, you might want to transfer them to a digital wallet. Some platforms charge a fee for this transfer. It's essential to check if the fee is fixed or varies depending on the amount you withdraw. A fixed fee can be more cost-effective if you're transferring a large amount.

Exchange rate fees can also play a role. When you use a credit card or bank transfer in a different currency, you might face a currency conversion fee. This fee is often hidden in the exchange rate offered by the platform. Comparing the exchange rate with the market rate can help you spot any discrepancies.

Some platforms offer discounts or even waive fees for using their native tokens or certain payment methods. For instance, if a platform has its token and you use it to pay for fees, you might get a discount. It's worth checking if such options are available to reduce your costs.

Lastly, be aware of inactivity fees. If you have an account on a platform but don't use it for a while, some platforms charge an inactivity fee. This is less common but can catch you off guard if you plan to hold your stablecoins for a long time without frequent activity.

To sum up, different platforms have different fee structures. It's crucial to read the fee schedules of various exchanges and platforms before deciding where to buy your USDT, USDC, or DAI. This knowledge will help you make informed decisions and keep more of your money in your pocket.

Security Tips When Buying Stablecoins

When you're diving into the world of stablecoins like USDT, USDC, and DAI, security should be at the top of your list. Let's break down some simple yet effective tips to keep your investments safe.

First things first, always use a secure and reputable exchange for your transactions. Popular exchanges often have stronger security measures in place, reducing the risk of hacks. Do a little research to find out which platforms have the best track record for security.

Another important step is to enable two-factor authentication (2FA) on your accounts. This adds an extra layer of protection by requiring not just a password, but a second piece of information that only you have access to. It's like having a double lock on your door.

Keep your private keys safe and never share them with anyone. Think of private keys as the password to your wallet. If someone else gets hold of them, they can access your funds. Consider using a hardware wallet to store your cryptocurrencies offline, away from online threats.

Phishing scams are another thing to watch out for. These are fake websites or emails that try to steal your information by pretending to be legitimate. Always double-check the URLs of the sites you visit and be cautious of links in emails.

Regularly update your software and wallets to the latest versions. Updates often contain security enhancements that protect against new threats. It's like keeping your antivirus software up-to-date to fend off viruses.

Lastly, be mindful of the information you share online, especially on social media. Publicly revealing details about your cryptocurrency holdings can make you a target for cybercriminals.

By following these tips, you can help secure your transactions and enjoy a safer experience in the world of stablecoins.

Conclusion: Your Path to Stablecoins

Navigating the world of stablecoins like USDT, USDC, and DAI can seem daunting at first. These digital currencies offer a stable alternative to more volatile cryptocurrencies. They are pegged to the value of traditional currencies, making them less subject to wild price swings. Let's explore how you can confidently step into the stablecoin space.

Imagine you're standing at the crossroads of traditional finance and the digital world. Stablecoins are like a bridge between these two realms. They combine the stability of fiat currencies with the advantages of blockchain technology. This makes them an attractive option for both seasoned investors and newcomers alike.

When you're considering buying stablecoins, think about why you want them. Are you looking to invest, send money overseas, or simply diversify your holdings? Knowing your purpose can help you choose the right stablecoin. For instance, USDT is widely used and easily accessible on many exchanges. USDC, on the other hand, is known for its transparency and regulatory compliance. DAI offers a decentralized option, which can appeal to those wary of centralized control.

Once you've decided on the stablecoin, it's time to find the best way to buy it. Consider factors like transaction fees, speed, and ease of use. You might choose a centralized exchange for its convenience or a decentralized one for its privacy. Each has its pros and cons, so weigh them carefully.

Before making a purchase, ensure your digital wallet is ready. This wallet will store your stablecoins securely. There are different types of wallets, such as hardware, software, and mobile wallets. Choose one that suits your needs and provides robust security.

Security is crucial when dealing with digital assets. Always use strong passwords and enable two-factor authentication. Be wary of phishing scams and other online threats. Keeping your assets safe is just as important as buying them.

As you venture into stablecoins, stay informed about market trends and regulatory changes. The world of cryptocurrency is ever-evolving, and being updated will help you make better decisions. Engage with online communities, read news articles, and follow industry experts to deepen your understanding.

Your journey into stablecoins can be rewarding. With careful planning and informed choices, you can make stablecoins work for you. Whether it's for investment, transactions, or hedging against volatility, stablecoins offer a world of opportunities. Embrace this digital frontier with confidence, and you'll find a stable path forward.

FAQ

What are stablecoins and why are USDT, USDC, and DAI popular?

Stablecoins are cryptocurrencies designed to minimize price volatility by being pegged to a reserve of assets, like fiat currency. USDT, USDC, and DAI are popular because they offer stability, making them ideal for trading, hedging, and transfers within the crypto ecosystem.

Why should I consider buying USDT, USDC, or DAI?

These stablecoins are beneficial for preserving value, facilitating seamless crypto transactions, and providing a reliable medium for trading and investment strategies without the volatility of other cryptocurrencies.

How do I choose the right exchange for buying stablecoins?

Look for exchanges with competitive rates, low fees, strong security measures, good user reviews, and those that offer the trading pairs you need. Consider factors like liquidity, user interface, and customer support as well.

Is it cost-effective to buy stablecoins using a bank transfer?

Yes, bank transfers often have lower fees compared to credit/debit card purchases. However, it's important to check the exchange's fee schedule and processing times to minimize costs and delays.

What should I know about buying stablecoins with a credit or debit card?

Purchasing with a credit or debit card is convenient but usually comes with higher fees and lower purchase limits. Ensure you're aware of the costs and verify the legitimacy and security of the platform you're using.

How can I use Peer-to-Peer (P2P) platforms to buy stablecoins?

P2P platforms allow you to buy stablecoins directly from other users, often at competitive rates. Ensure you use reputable platforms, check user ratings, and follow security measures to protect your transactions.

Are there any security tips I should follow when buying stablecoins?

Always enable two-factor authentication, use secure wallets, verify the legitimacy of exchanges or sellers, and avoid sharing personal information. Regularly monitor your accounts and transactions for any suspicious activity.

.avif)